And eventually, gold as well as other physical precious metals are the final word hedge towards likely losses by other well-known investments like shares, bonds, and currencies, because historically Talking, when most other investment cars collapse or flounder, precious metals recognize and excel.

This sort of resilience is strictly why so Lots of people are including gold to their portfolios now, Particularly as inflation Again gets to be a urgent worry in 2024.

When A serious correction happens, investors possess the inverse possibility, to seize principal and profit from their precious metal investments and reacquire shares, bonds, and currencies at discount charges. And all of this happens over a tax-totally free basis, until eventually it is necessary for retirement, when buyers are inside of a lessen earnings tax bracket.

An knowledgeable Trader is vital in right now’s elaborate financial landscape, so investor schooling can't be underestimated In terms of IRAs that maintain precious metals like gold as backings. Gold IRAs have grown significantly well known as tangible, historically steady assets present protection from inflation and marketplace instability – as a result why gold IRA companies will have to supply educational methods; IRA companies like Noble Gold, Edge Gold or Birch Gold Group to just identify a couple of all provide different levels of academic written content; let’s study why.

With the appropriate awareness and aid, purchasing gold for retirement can be quite a straightforward and financially rewarding endeavor. American Hartford Gold invests in educating its shoppers. The organization Web site incorporates a wealth of knowledge and no cost assets for each newcomers and expert gold buyers.

Owning physical gold is pricey and complicated. So shopping for gold shares is a good way for unique buyers to have the exposure they want in their portfolios. Forbes Advisor has compiled an index of the best gold shares that have found growing profits and powerful inventory efficiency.

Traditional IRA: Contributions may very well be tax-deductible depending on someone’s cash flow and access to an employer-sponsored Related Site retirement approach; earnings improve tax deferred until finally withdrawals begin (generally right after achieving retirement age).

It’s essential you happen to be conscious Secure gold storage and protection of such regulations in order to avoid possible penalties or early distribution costs.

Tax-Deferred Advancement: As with classic IRAs, expansion in a gold IRA is tax deferred right up until distributions manifest – this allows your investments to compound after some time with no annual stress of annual tax payments sabotaging them.

While gold will make for a good addition to some retirement portfolio, buyers have to have to completely understand its different sorts as well as their respective advantages and disadvantages prior to investing. Consulting a financial advisor skilled with Gold IRAs and BBB grade investments may well assistance buyers make extra informed conclusions that align with their retirement aims and possibility tolerance.

Take full advantage of the best offer underneath, or Click this link to discover our Leading ten Gold IRA Firm reviews and see how savvy buyers are safeguarding their financial upcoming.

Merely mentioned, no unique may well work as their own individual custodian for a person Retirement Account or Gold IRA. In keeping with IRS restrictions, only capable trustees his response or custodians are approved to hold these types of assets – this assures compliance with regulations and polices whilst safeguarding the two account holder interests and also govt kinds. Research gold IRA companies and come across the appropriate healthy for the precious metals.

All companies offer gold IRAs but some of them also provide excellent instructional equipment, clear pricing, cost-free supply, storage solutions etc… To become initial in our position, a firm has to obtain everything. This is certainly why AHG is our primary decision.

In spite of gold IRAs being a fantastic investment alternative, most experts endorse only to invest involving 5 and 15%, dependant upon your current portfolio. Splitting investment platforms to aid hedge against potential changes.

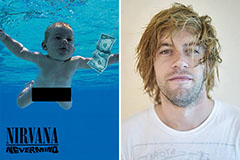

Spencer Elden Then & Now!

Spencer Elden Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!